Leveraging Private Sector Participation in Blended Finance for Climate Resilience

In the face of escalating climate challenges, innovative financing mechanisms are crucial for mobilizing resources to combat climate change. According to the Climate Policy Initiative’s estimates, an investment of US$ 266 trillion is required between now and 2050 to mitigate and adapt to climate change effectively. Blended finance has proven effective in funding climate resilience projects. Drawing from IsDB’s expertise in blended finance that targets public investments, there is an opportunity for IsDB to leverage its experience to structure similar vehicles aimed at catalyzing private sector investments at scale. By aligning these efforts with the Sustainable Development Goals (SDGs) and climate objectives, IsDB can play a transformative role in driving private sector engagement in climate resilience.

The Lives and Livelihoods Fund (LLF):

At the forefront of blended finance initiatives is the Lives and Livelihoods Fund (LLF), a flagship facility housed at the IsDB Group. The US$ 2.5 billion blended finance vehicle, uniquely leveraging concessional financing, works to lift the poorest out of poverty across 33 IsDB member countries through public investments in primary health and infectious diseases, small-holder farming and rural agriculture, and basic infrastructure. The portfolio of projects approved by the LLF from 2016 to 2021 is already transforming thousands of lives and livelihoods spanning sub-Saharan Africa, the Maghreb, the Middle East, Central Asia, and Asia. Since its creation in 2016, its financing has benefitted over 3 million smallholder farmers to improve their productivity and livelihoods, providing access to quality healthcare for 12.5 million women and children, and is expected to provide over 7.5 million people with better water and sanitation facilities.

The LLF’s investments in Pakistan illustrate the case for blended finance. By pooling public resources with philanthropic contributions, keen to support a national health priority, the LLF actively supported the highly impactful Pakistan Polio Eradication Initiative with US$160 million in concessional financing. This support strengthened the program’s operations, enhanced its surveillance capabilities, facilitated vaccine procurement and social mobilization, and improved its communications, maximizing the impact of the program leading to 99% reduction in polio incidence. The LLF’s support has helped ensure that all children under five are immunized, vaccinators are afforded training and support, and communities are made aware of the importance of polio vaccination.

Linkages with SDGs:

The LLF channels public funding towards climate-resilient infrastructure, healthcare systems, sustainable agriculture, and renewable energy projects that address multiple SDGs in target countries. The LLF, through its integrated approach, with its crosscutting focus on climate adaptation and gender equality, delivers solutions that span multiple SDGs across several countries.

From Public to Private Investments: Unlocking Private Sector Engagement:

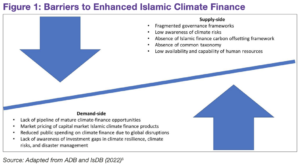

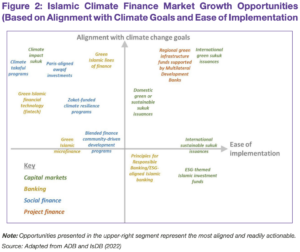

Building on the LLF success, taking into account public debt constraints in the Global South, as well as the extent of the 15-figure financing gaps to achieve both the SDGs and climate goals, IsDB can pivot towards structuring similar blended finance vehicles targeting private sector investments. By leveraging financial instruments such as grants, junior debt, junior equity, or guarantees, coupled with reputational support and local expertise, IsDB can reduce investment risks and create attractive opportunities for commercial investors. This approach not only unlocks new sources of funding for climate resilience projects but also fosters innovation and entrepreneurship in IsDB member countries.

The transition from public to private sector investments would align closely with IsDB’s commitment to the SDGs and climate action. By focusing on sectors such as renewable energy, sustainable agriculture, and climate-smart infrastructure, the IsDB can continue to promote its integrated approach to achieving impact across the SDGs, including poverty eradication, gender equality, and climate resilience. Specifically, by integrating climate considerations into its investment strategies, IsDB could contribute to global efforts to mitigate the impacts of climate change.

This would require strategic partnerships and innovative financing structures. IsDB could collaborate with multilateral development banks, philanthropic organizations, and private sector entities to design blended finance vehicles tailored to the needs of private investors. By providing technical assistance, capacity building, and financial incentives, IsDB can catalyze private sector engagement in climate resilience projects at scale, driving sustainable development and economic growth.

IsDB is uniquely positioned to drive private sector engagement in climate resilience by leveraging its network of partners and extensive experience and expertise in blended finance. By harnessing the power of public, private, and philanthropic resources, IsDB can structure innovative financing mechanisms that de-risk and mobilize private capital for initiatives aligned with the SDGs and climate goals. As IsDB transitions from public to private sector investments, it can play a transformative role in driving sustainable development and building climate resilience in IsDB member countries and beyond. As the global community intensifies efforts to combat climate change, embracing innovative financing mechanisms is crucial to creating a more sustainable and resilient future for all.

This article was originally published in the IsDB SDG Digest – Issue 19- Cherishing our Past Charting our Future, April 2024

read more